KCRW

Featured Shows

Popular

MBE Playlist April 12: Novena’s guide to Coachella ‘24

Best New MusicNovena gives you Coachella tips. Plus, a cut from SHABAKA’s introspective new LP “Perceive Its Beauty, Acknowledge Its Grace”.

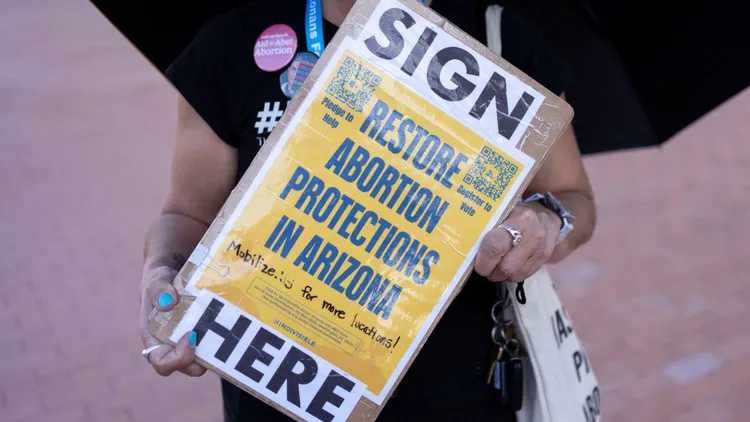

Trump takes no stakes-stance on abortion

PoliticsIs there anything about Trump’s abortion position for Joe Biden to capitalize on? Will Biden’s change of tune on Israel win him more supporters?

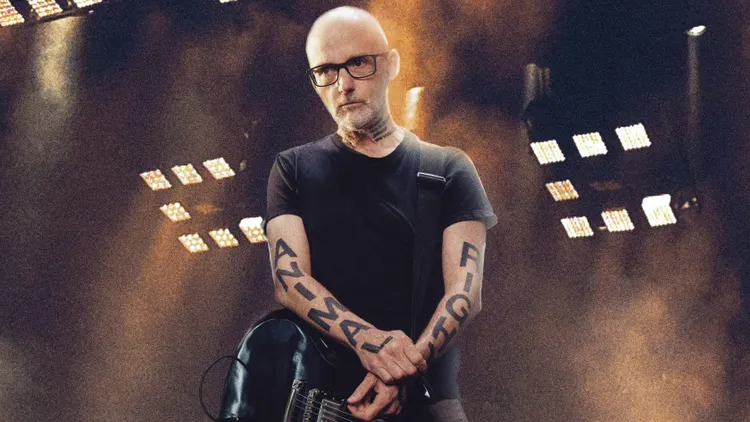

Metropolis playlist, April 13, 2024

Best New MusicJason Bentley captures the hypnotic pulse of modern city life on Saturday night.

KCRW Broadcast 784

MusicFanatic! I hope you had a great week with as much music as possible played.